Sobs of relief filled the federal courtroom in Kansas on Monday as dozens of individuals, whose life savings had been stolen by a bank CEO, received the news that federal law enforcement had successfully retrieved their money.

Bart Camilli, 70, along with his wife Cleo, expressed their indescribable relief upon learning that they would be recovering nearly $450,000. This significant sum of money holds tremendous value for Bart, who had diligently saved it since he was 18 when he opened his first individual retirement account. The positive impact this recovery will have on their lives cannot be overstated.

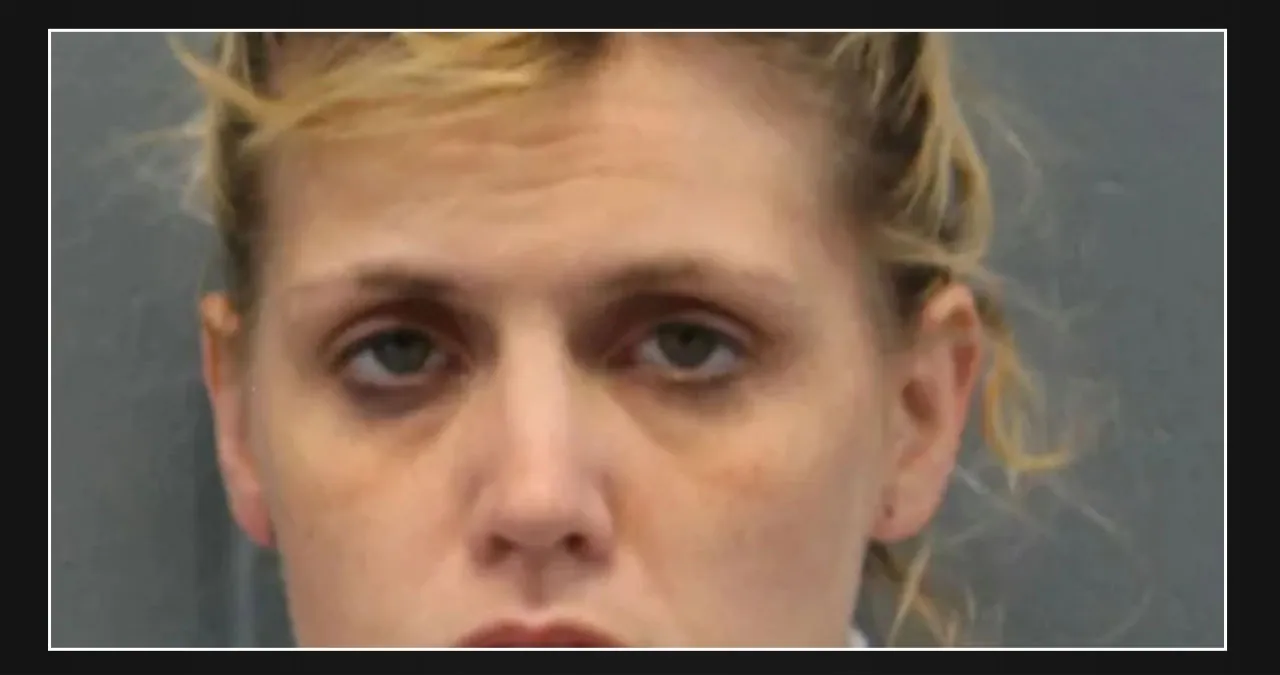

In August, a former Kansas bank CEO, Shan Hanes, received a 24-year sentence for his involvement in a case where he embezzled $47 million from customer accounts and transferred the funds to cryptocurrency accounts managed by scammers. Additionally, Hanes was found guilty of stealing $40,000 from his church, $10,000 from an investment club, and $60,000 from his daughter’s college fund. Furthermore, he suffered personal losses of $1.1 million as a result of the scheme. Prosecutor Aaron Smith described how the deposits were essentially lost and untraceable, stating that they were “jettisoned into the ether.”

Hanes’ Heartland Tri-State Bank, which had run out of cash, was closed by federal regulators and acquired by another financial institution. The Federal Deposit Insurance Corp. insured customers’ savings and checking accounts, totaling $47.1 million, and reimbursed them for their losses.

However, there were still 30 shareholders of the community-owned rural bank that Hanes had helped establish. These shareholders, who were close family friends and neighbors, believed that they had lost $8.3 million in investments. As a result, their meticulously planned retirements were disrupted, the funds they had set aside for long-term eldercare were depleted, and the education funds and bequests they had intended for their children and grandchildren were reduced to nothing.

On Monday, the shareholders erupted in applause as federal Judge John W. Broomes in Wichita individually assured them that they would receive full reimbursement. The funds, which had been seized by the FBI, were successfully recovered from a cryptocurrency account controlled by Tether Ltd. in the Cayman Islands.

During a previous sentencing hearing, these victims referred to Hanes as a “deceitful cheat and a liar” and described him as “pure evil.”

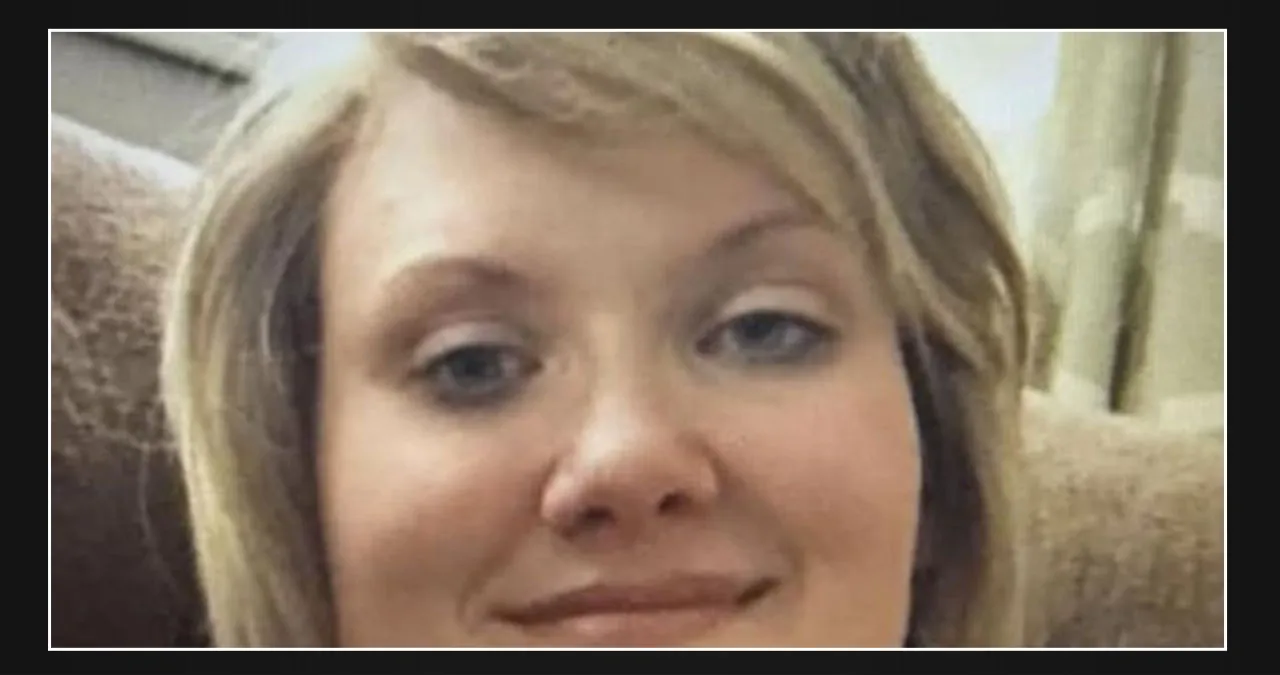

Margaret Grice walked into the courtroom on Monday with the expectation of receiving a mere $1,000 refund. However, to her immense surprise, she discovered that she would actually be reclaiming a substantial sum of nearly $250,000 – the entirety of her 401(k) savings.

“I am absolutely thrilled,” she exclaimed. “Finally, I can breathe freely.”

Hanes, the former CEO of Heartland Tri-State Bank in Elkhart, Kansas, fell victim to a scam known as “pig butchering,” where individuals are deceived into investing their entire savings into cryptocurrency, only for it to vanish instantly. This type of scam involves a trusted third party who gradually convinces the victim to invest all their funds, only to make them disappear. According to U.S. and U.N. authorities, these schemes are on the rise, with scammers, particularly from Southeast Asia, targeting American victims.

According to court records, Hanes fell victim to a cryptocurrency scam in late 2022. It all began when he started communicating with someone on WhatsApp, believing he was investing $5,000 in cryptocurrency. Over time, he went on to transfer his church and investment club funds as well. The scam intensified during the summer of 2023, as Hanes wired a staggering $47.1 million out of customer accounts through 11 wire transfers in just eight weeks. He believed each transfer was necessary to cash out his investment. To his dismay, Hanes witnessed the apparent growth of his money to over $200 million on a fake website.

According to his attorney, John Stang, the plan was for him to keep a portion of the money and return the remaining amount to the bank. However, as Stang explained, this plan turned out to be nothing more than a work of fiction. It was a complete failure.

Hanes, who did not appear in court on Monday, expressed his apologies during a previous sentencing hearing.

“I deeply regret the harm I caused,” he expressed sincerely. “I never intended to cause any harm, and it pains me to know the consequences of my actions. I will always struggle to comprehend how I was deceived and how my attempts to recover the money only made the situation worse.”

In May, Hanes pleaded guilty to embezzlement by a bank officer. According to prosecutors, Hanes didn’t just fall victim to a scam; he went beyond that by accepting customers’ money and breaking banking regulations.

According to a Federal Reserve System investigation, his well-respected position in his hometown of 2,000 people made it more convenient for him to evade detection. Prior to the investigation, he had held various influential roles such as serving on the school board, volunteering as a swim meet official, and being a part of the Kansas Bankers Association.

He not only held a prominent position within his rural community but also emerged as a distinguished figure in the banking sector. Over the years, he provided valuable testimony to Congressional committees, emphasizing the significance of local banks in agricultural communities. Additionally, he played an active role as a director for the American Bankers Association, which represents a substantial portion of banking assets in the United States.

Prosecutors announced on Monday that the FDIC is seeking repayment for the insurance claims it reimbursed to bank customers. However, Judge Broomes argued that given the economic hardships faced by shareholders who were victims of a fraud scheme, it is only fair to prioritize their repayment before the FDIC recovers any funds.

Hanes, who is currently 53 years old, may not be released until he reaches his late 70s. It is highly unlikely that he will be able to repay the FDIC the remaining $47.1 million that he owes.

Hanes and his attorney made an attempt to clarify the events in a court filing.

According to the statement, Mr. Hanes made some unfortunate decisions when he became involved in a highly organized cryptocurrency scam. The statement further describes him as the one who suffered the consequences of his actions, likening him to a pig that was ultimately butchered.