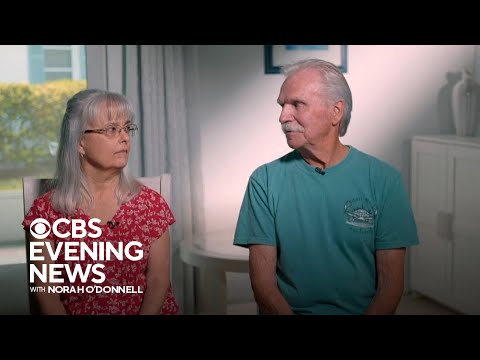

St. Petersburg, Florida — Larry Gesick, a 77-year-old electrician, leaves his home at 5:30 a.m. and heads to his part-time job unloading trailers at a local supermarket in St. Petersburg for $14.75 an hour. This wasn’t part of his retirement plan.

His wife, 66-year-old Joyce, also prepares for her workday, earning $14 an hour as a full-time legal administrator.

“It’s not really a retirement,” Joyce told CBS News. “…It’s working every day.”

The Gesicks returned to work not by choice but out of necessity. According to the Pew Research Center, about one in five people over age 65, or roughly 11 million Americans, are still working.

Labor economist Teresa Ghilarducci argues that work has become the new retirement.

“I call it the work, retire, repeat syndrome,” Ghilarducci said. “More than half of the people who are retired right now do not have enough money to be retired.”

She attributes this issue to “policymakers who experimented with our retirement system 40 years ago, and they are not acknowledging that the experiment failed.”

That experiment is what we now know as the 401(k), a system introduced by a 1978 law that provided companies with an alternative to traditional pension plans.

“The idea was that Americans just needed a bit of financial literacy to save on their own,” Ghilarducci said.

However, many older workers today were never adequately educated about saving and investing for retirement.

“I grew up on a farm,” Larry said. “Nobody there instructed any of us to put money aside and make our own way later on down the road.”

Whether you’re over 65 like the Gesicks or approaching that age, it’s important to keep a few key rules in mind. First, determine the optimal time to claim Social Security. Next, build an emergency reserve. If you’re still working, aim to save six to twelve months’ worth of living expenses. If you’re retired, save one to two years’ worth. Keep this reserve in a safe, easily accessible, interest-bearing account.

The Gesicks, like many Americans, were more focused on doing than saving and ended up depleting their 401(k)s.

“It felt more like a savings account to us rather than something to rely on for living expenses,” Joyce said.

Now, with a mortgage, a car loan, and about $12,000 in other debt, their financial situation is tight. Even with Social Security, some old pension funds, and their paychecks, they are left with just $50 after covering their expenses and debt each month. Had they waited until age 70 to claim Social Security, they would be receiving more.

“Yeah, it’s stressful now,” Joyce said. “But I think we can see the light at the end of the tunnel.”

reference article

https://www.pewresearch.org/social-trends/2023/12/14/the-growth-of-the-older-workforce/

https://www.cbsnews.com/news/american-seniors-not-enough-retirement-savings/